Deposits & Withdrawals: A Complete Guide

How to Deposit Cryptocurrency

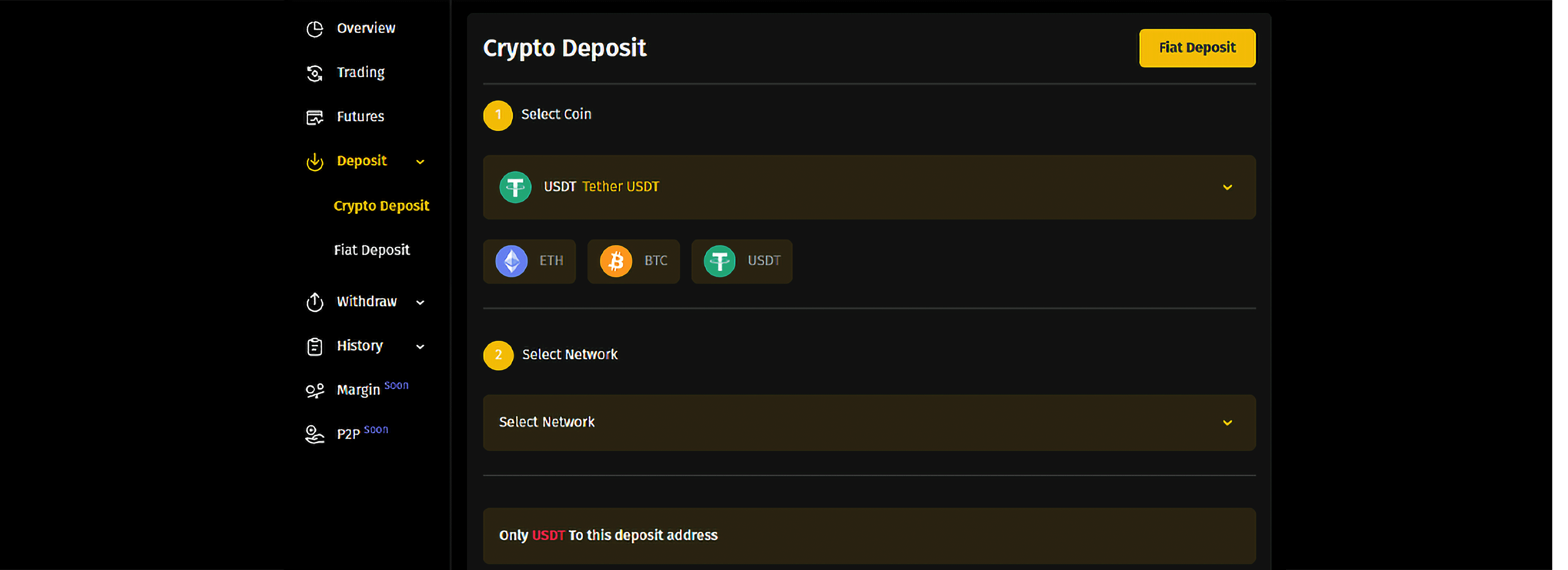

Depositing cryptocurrency into your account is a straightforward process. Follow these steps:

- Log in to Your Account: Access your cryptocurrency exchange or wallet using your credentials.

- Navigate to the Deposit Section: Locate the “Deposit” or “Funds” tab in your account dashboard.

- Select the Cryptocurrency: Choose the digital asset you want to deposit (e.g., Bitcoin, Ethereum, USDT).

- Generate a Wallet Address: The system will provide you with a unique wallet address for the selected cryptocurrency.

- Transfer Funds: Copy the wallet address and use it to send the cryptocurrency from your external wallet or another exchange.

- Confirm the Transaction: Wait for blockchain confirmations, which vary depending on the cryptocurrency’s network.

- Check Your Balance: Once the transaction is completed, the funds will appear in your account.

Important Notes:

- Always double-check the wallet address before sending funds to avoid irreversible losses.

- Network fees may apply, depending on the blockchain used.

How to Deposit Fiat Currency (If Supported)

If the platform supports fiat deposits, follow these steps:

- Verify Your Account: Many exchanges require identity verification (KYC) before allowing fiat deposits.

- Go to the Deposit Section: Select the “Deposit” or “Add Funds” option.

- Choose a Payment Method: Common options include bank transfer, credit/debit cards, or third-party payment processors.

- Enter Deposit Details: Provide the required information, such as the deposit amount and currency.

- Complete the Transaction: Follow the on-screen instructions to initiate the deposit.

- Wait for Confirmation: Processing times vary based on the payment method and bank policies.

- Check Your Balance: Once processed, the fiat currency will reflect in your account.

Important Notes:

- Some platforms charge fees for fiat deposits, which vary by payment method.

- Bank transfers may take longer than card payments.

Withdrawal Limits and Security Measures

Exchanges impose withdrawal limits and security protocols to enhance user protection. Here’s what to consider:

Withdrawal Limits

- Daily/Monthly Limits: Most platforms have a cap on how much users can withdraw within a specific timeframe.

- Verification Levels: Higher verification levels often allow larger withdrawal limits.

- Cryptocurrency vs. Fiat Limits: Limits may differ based on the asset being withdrawn.

Security Measures

- Two-Factor Authentication (2FA): Enabling 2FA adds an extra layer of security to withdrawals.

- Whitelisted Addresses: Some platforms allow withdrawals only to pre-approved wallet addresses.

- Withdrawal Confirmation Emails: Users may need to confirm transactions via email.

- Anti-Phishing Codes: Prevents fraudulent withdrawal requests by verifying authenticity.

Processing Times and Fees

Processing times and fees depend on the platform and the type of withdrawal.

Processing Times

- Cryptocurrency Withdrawals: Typically take a few minutes to a few hours, depending on network congestion.

- Fiat Withdrawals: Bank transfers can take 1–5 business days, while card withdrawals may be faster.

Fees

- Blockchain Fees: Cryptocurrency withdrawals incur network fees, which vary by asset.

- Exchange Fees: Some platforms charge additional withdrawal fees.

- Bank Fees: Fiat withdrawals may be subject to banking charges, depending on the payment method.

By understanding these aspects, users can effectively manage their deposits and withdrawals while ensuring security and efficiency in their transactions.